Sensible conversations supported by artificial intelligence increased the efficiency rate of credit card cross-sell efforts by 82% at a Mexican bank.

Frank. Good morning! This is Frank from W Bank. May I speak with Ms. K?

Sandra (with a distraught voice). She is unavailable.

...

Frank. Good morning! This is Frank from W Bank. May I speak with Ms. K?

Sandra (with a distraught voice). She is unavailable.

Frank. Could you tell her that she has a pre-approved card with a $5,000 credit limit?

Sandra. Ms. K died yesterday.

Frank. Let her know that there are no annual fees!

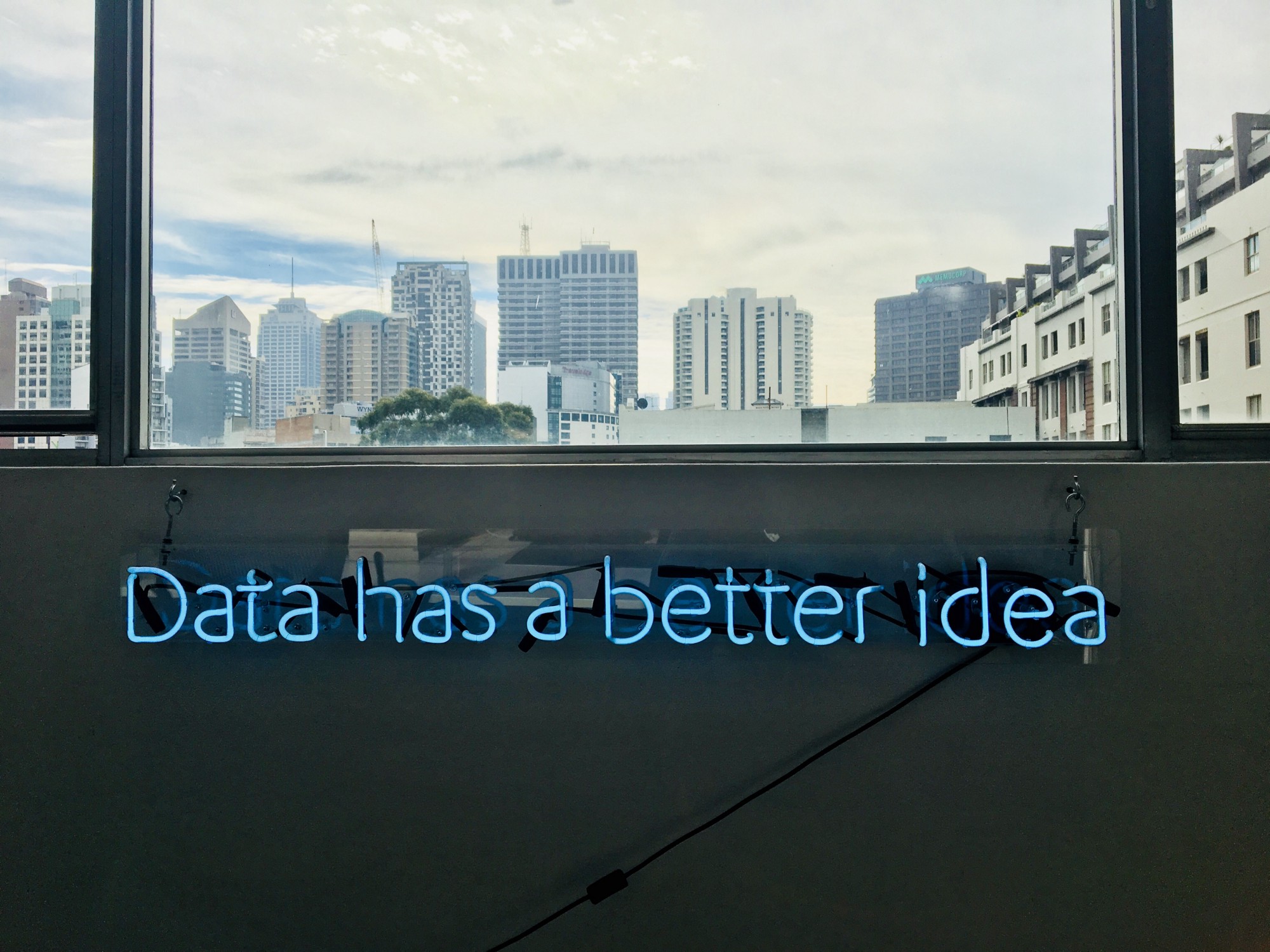

Would you be surprised if you got entangled in such an absurd conversation? Companies hold millions of meaningless conversations with their customers every day. Scripted call center dialogues assume that vendors have nothing to learn from consumers. These interactions yield poor outcomes: at its best customers reject valuable propositions, while at its worst companies risk the long term business relationships with their customers. Artificial intelligence has too often worsened this trend by making conversations even more rigid, with machines supervising human compliance to an inconsiderate script and artificial agents being unable of understanding customer needs adequately.

Among the companies attempting to overcome the challenge posed by making meaningful communication at scale is Grupo Financiero Banorte (GFNorte), the second largest financial group in Mexico. GFNorte has made its mission to engage in more sensible conversations with its customers supported by artificial intelligence. However straightforward this approach may sound, it has yielded astounding results: the efficiency rate of credit card cross-sell efforts has increased by 82%, meaning that — only after six months of polishing dialogues — 4 out of 10 sales pitches result in a purchase. The lift is explained by two effects: more customers attend to the offer and the odds that a purchase is made are considerably higher after they talk to the agent.

After listening to thousands of conversations GFNorte has developed a better understanding of customer concerns. This has given way to a new two-stage communication strategy for credit card offers. First, the bank has anticipated customer concerns through noninvasive channels such as mobile app and SMS messaging, and second human agents have been trained to deliver succinct sales pitches with suitable answers to the questions posed by customers. Improving the way agents talk has proven to be cost-efficient, for the time spent per successful sale dropped 16%, reducing call abandonment and freeing human resources.

Mindfully crafting communication was not enough; success came from an iterative process, guided by a champion-challenger methodology. GFNorte learned that it could learn more about which product features were valued by their customers. Also, it became clear that agents had difficulty in explaining the financial advantages customers may derive from a credit card or how their product fared against the competition. It should not be surprising that the gains after the first communication redesign attempt were only a quarter of what was obtained after the sixth try –with incremental gains on each improvement round.

The new communication strategy acknowledged that carefully thought messages, independently of who produced them, had to be challenged. High returns to this approach contributed to building an analytics testing culture within the company. One that has lessened the weight of institutional hierarchy in considering which ideas are carried out and which ones are discarded.

Testing more ideas on how to communicate with the customers might prove to be challenging: the team will have to work more (typically the new hires arrive after a strategy proves to be profitable), stakeholders are defined (some feel confident about their customer knowledge and mistrust testing) and, even worse, revenue might not improve immediately. It is therefore not surprising that firms are derailed when they try to instill a testing culture. In GFNorte´s case experimentation fatigue has not played a role. I think that at least three things were done right:

- Artificial intelligence reduced a complex problem and accelerated the discovery process to yield early wins, thus fueling the enthusiasm on communication redesign.

- Humility, an unusual trait amongst bankers, to acknowledge that they could learn from what their customers told them and act upon that knowledge.

- Stubbornness from the stakeholders in their belief that they could do it better on each champion-challenger round.

Companies that engage in meaningful conversations with their customers unleash the potential to build deeper and more durable business relations, which ultimately translate into equity. The principles which GFNorte employed to stop absurd dialogues can be replicated by other organizations beyond the financial services industry. The novel strategic aspect, in the egocentric era which we live in, is listening to the customers while assuming that they know something that the bank does not. However, the extraordinary results shown in this case cannot be explained without the willingness of the corporation to try out new things: as it generally happens the vessel is more important than the oarsmen!

Jose Murillo, Chief Analytics Officer at Grupo Financiero Banorte will join the global WSAI community as speaker at World Summit AI Americas April 10-11 in Montreal, Canada.

.png?width=259&name=WSAI%20Amsterdam%20Orange%20no%20dates%202000x300%20(1).png)

.png?width=263&name=IM_Mothership_assets_LOGO_MINT%20(2).png)